Looking for a new job isn't actually ‘taxing' after all. Did you know that you can deduct costs related to your job when you file? All the things like paying for LinkedIn Premium, hiring a recruiter and good ol' printing and mailing resumes can add up.

Here's a list of common deductions you can take:

- If you travel for an interview that's not paid for by the company you are interviewing with, you can deduct your expenses as long as the trip was for the sole purpose of finding a job.

- You can deduct costs around creating, printing and mailing resumes.

- You can also deduct the costs you incur by hiring a recruiter or job placement agency.

Things that disqualify you from taking job search deductions:

- Your search must be for a job within your current field and you are not looking for a job for the first time.

- There has not been a long gap in employment.

- The expenses you take on such as travel must be primarily related to your job search.

- If another party or employer reimburses you for the expenses you're not able to take the deductions.

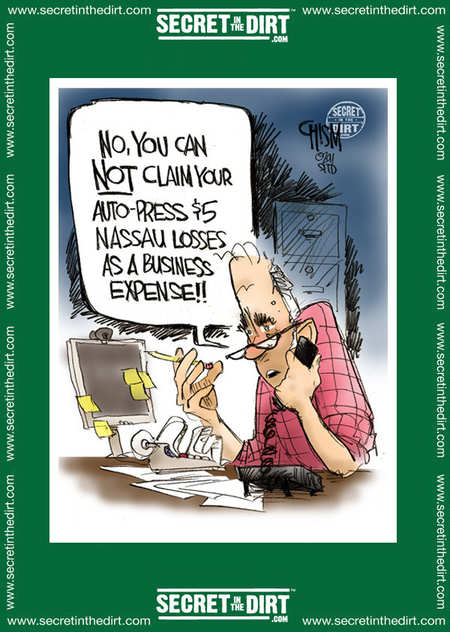

Of course, it's always best to have a professional like us to do your taxes so you don't increase your risks for an audit. Additionally, we may be able to find even more deductions you can take; everyone's situation is unique.

Image courtesy of Secret in the Dirt on flickr; reproduced under Creative Commons 2.0

Category:

Tips

Posted on

September 17, 2013