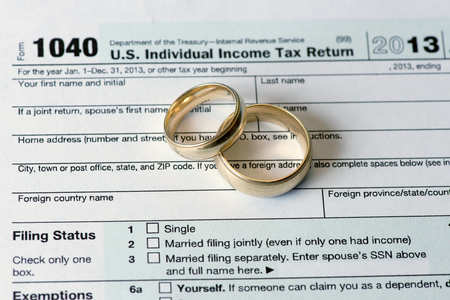

The following questions and answers provide information to individuals of the same sex who are lawfully married (same-sex spouses). These questions and answers reflect the policy outlined in Revenue Ruling 2013-17 in 2013-38 IRB 201.

Q1. When are individuals of the same sex lawfully married for federal tax purposes?

A1. For federal tax purposes, the IRS looks to state or foreign law to determine whether individuals are married. The IRS has a general rule recognizing a marriage of same-sex spouses that was validly entered into in a domestic or foreign jurisdiction whose laws authorize the marriage of two individuals of the same sex, even if the married couple resides in a domestic or foreign jurisdiction that does not recognize the validity of same-sex marriages.

Q2. Can a taxpayer and his or her same-sex spouse file a joint return if they were married in a state that recognizes same-sex marriages but they live in a state that does not recognize their marriage?

A2. Yes. For federal tax purposes, the IRS has a general rule recognizing a marriage of same-sex individuals that was validly entered in a domestic or foreign jurisdiction whose laws authorize the marriage of two individuals of the same sex, even if the married couple resides in a domestic or foreign jurisdiction that does not recognize the validity of same-sex marriages.

Q3. Can a taxpayer’s same-sex spouse be a dependent of the taxpayer?

A3. No. A taxpayer’s spouse cannot be a dependent of the taxpayer.

Q4. If same-sex spouses (who file using the married filing separately status) have a child, which parent may claim the child as a dependent?

A4. If a child is a qualifying child under section 152(c) of both parents who are spouses (who file using the married filing separate status), either parent, but not both, may claim a dependency deduction for the qualifying child.

Q5. Can a taxpayer who is married to a person of the same sex claim the standard deduction if the taxpayer’s spouse itemized deductions?

A5. No. If a taxpayer’s spouse itemized his or her deductions, the taxpayer cannot claim the standard deduction (section 63(c)(6)(A)).

Q6. Can a same-sex married couple elect to treat a jointly owned and operated unincorporated business as a Qualified Joint Venture?

A6. Yes. Spouses that wholly own and operate an unincorporated business and that meet certain other requirements may avoid Federal partnership tax treatment by electing to be a Qualified Joint Venture.

Related Items:

-

IRS YouTube Video: Tax Information About Same-Sex Marriage in English / Spanish / ASL

-

IR-2014-22, New IRS Video Helps Same-Sex Couples; Joins Extensive IRS Library Of Online Tax Tips

-

IR-2013-72, Treasury and IRS Announce That All Legal Same-Sex Marriages Will Be Recognized For Federal Tax Purposes; Ruling Provides Certainty, Benefits and Protections Under Federal Tax Law for Same-Sex Married Couples

-

Frequently Asked Questions on Estate Taxes (estate tax marital deduction for same-sex couples)

-

Frequently Asked Questions on Gift Taxes (gift tax marital deduction for same-sex couples)